Cost-Effective

Enjoy quick, user-friendly services available worldwide. Start with just one document

Enjoy quick, user-friendly services available worldwide. Start with just one document

Your personal data is safeguarded with top-tier security. We're here to support you

Complete your application in under 10 minutes with instant money transfers

Open the app and fill out a straightforward application form—quick and hassle-free.

Get a decision in no time! Our process typically takes just 15 minutes.

Funds are sent directly to your account for use in under a minute.

Apply through the app by completing the necessary form.

Download loan app

When it comes to financial emergencies or unexpected expenses, having access to fast loan app in Kenya can be a lifesaver. These platforms provide quick and convenient options for individuals needing immediate cash. Zenka, a popular lending platform in Kenya, offers loans up to 5,000 Kenyan Shillings to help individuals cover their short-term financial needs.

Finding legit loan apps in Kenya is essential for a safe and transparent borrowing experience. These platforms stand out for their reliability and straightforward application processes, ensuring borrowers can access funds without unnecessary complications. Legitimate loan apps ensure data security, clear terms, and prompt loan disbursements, making them a trusted choice for many Kenyans. Additionally, they prioritize user education by providing detailed guidance on loan terms and repayment expectations. By selecting trustworthy apps, borrowers can avoid predatory practices and confidently address their financial needs without fear of hidden charges or unfair conditions.

When financial needs arise suddenly, a quick loan can provide an immediate solution. Fast loan apps are designed for efficiency, with minimal application requirements and rapid approval times, making them ideal for emergencies. Whether it's for medical expenses, tuition fees, or urgent car repairs, these apps help borrowers bridge financial gaps swiftly. Many platforms also incorporate flexible repayment options, allowing users to tailor loan terms to their unique circumstances. This combination of speed and adaptability ensures quick loans remain an invaluable resource for managing unexpected expenses without disrupting financial stability.

For borrowers looking for easy loans in Kenya, fast loan apps simplify the entire process. These apps allow users to apply using just a smartphone and basic personal details, removing the barriers of traditional lending methods. With no need for collateral or guarantors, they cater to a wide audience, including those without access to formal banking systems. Their intuitive interfaces make them accessible to users of all experience levels, from first-time borrowers to seasoned users. Whether you’re covering school fees, home repairs, or personal expenses, these loans provide a seamless and practical way to meet your financial needs efficiently.

Reliable loan apps are essential for borrowers seeking quick and secure financial solutions. These platforms emphasize trust by safeguarding user data and ensuring loans are disbursed promptly as promised. Borrowers value transparency and flexibility, both of which are central to the services offered by these apps. They also include features such as real-time support, enabling users to resolve issues or ask questions throughout the borrowing process. Reliable loan apps are particularly useful for individuals in urgent financial situations, providing timely assistance with minimal delays. For those searching for a dependable option, these platforms stand out as a cornerstone of accessible and fair lending practices in Kenya.

Fast loan apps are versatile and can be used for various purposes, such as covering medical expenses, paying for school fees, or even funding small business ventures. These apps are especially popular among Kenyans seeking reliable and efficient solutions for their financial emergencies. The ease of access and user-friendly interfaces make them a preferred choice.

Whether it's quick loans Kenya or easy loan apps in Kenya, these platforms cater to a wide range of needs. Borrowers appreciate the transparency and flexibility offered by apps like Zenka, which continue to grow in popularity for their responsiveness and innovative features.

Fast loan app promote responsible borrowing, encouraging users to only take out loans they can afford to repay. This ensures borrowers maintain financial stability and avoid long-term credit challenges.

In conclusion, fast loan apps in Kenya provide a vital service for those facing urgent financial needs. Some platforms excel in offering fast, secure, and transparent solutions, making them a top choice for borrowers. Whether you need funds for an emergency or short-term expenses, apps like these deliver unparalleled convenience and reliability. If you find yourself thinking, "I need a loan urgently in Kenya," these apps offer a quick and dependable way to access the funds you need.

We connect borrowers in Kenya with trusted lenders, offering fast loan apps for amounts up to 30,000 KES and personal installment loans up to 350,000 KES.

To qualify for fast loan apps in Kenya, you need to be a Kenyan citizen, have a valid national ID, be over 18 years old, have a consistent source of income, and meet the specific credit scoring requirements of your chosen lender.

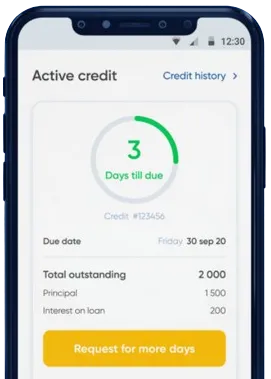

The repayment period for fast loan apps in Kenya typically ranges from 61 to 365 days for personal installment loans. For short-term quick loans, repayment terms may vary between 1 and 30 days, depending on the lender.

Yes, most fast loan apps in Kenya allow loan extensions. However, additional fees and interest may apply. It's advisable to contact your lender's customer support for detailed information about extending your repayment period.

Once your loan application is approved, you can typically receive the funds within minutes. Some lenders transfer money directly to your M-Pesa or bank account the same day or by the next business day, depending on the review process.

If you are unable to repay your loan on time, your lender may charge late fees, report the non-payment to credit bureaus, and potentially take legal action to recover the amount. It is always advisable to communicate with the lender early to explore alternative repayment options or extensions.